If you’re a newly registered Private Limited Company in Sri Lanka, don’t miss our 2025 Annual Compliance Guide. Learn how to file your Form 15, meet ROC and IRD deadlines, and stay fully compliant with Sri Lankan regulations.

Here’s your definitive 2025 compliance calendar, covering the Registrar General of Companies (ROC), Department of Inland Revenue (IRD), Sri Lanka Customs, and other relevant authorities.

ROC Compliance: Governance & Transparency

Annual Return (Form 15)

- Deadline: Within 30 working days after the AGM

- Includes: Updated director/shareholder details, registered address, share transfers

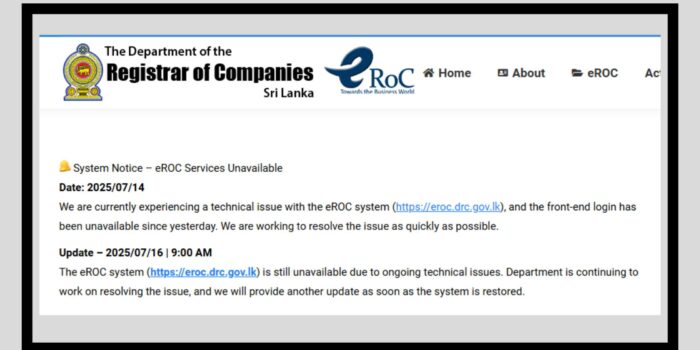

- How to File: Online via EROC portal

Financial Statements

- Audit Required: Yes, by a qualified auditor

- Deadline: Within 6 months of financial year-end

- Retention: Minimum 5 years

Board & Shareholder Meetings

- AGM: Mandatory annually

- Board Meetings: Documented minutes required

- Special Resolutions: Must be filed with ROC if passed

IRD Compliance: Taxation & Reporting

Corporate Income Tax

- Estimated Tax Statement: Due by August 15

- Final Return: Due by November 30

- Quarterly Payments: Based on estimated profits

VAT & WHT

- VAT: Monthly/quarterly returns if turnover > Rs. 75M

- WHT: Monthly remittance on dividends, rent, royalties, etc.

Sri Lanka Customs: Trade Compliance

Import/Export Registration

- Importer/Exporter Code: Mandatory

- Renewals: As per Customs guidelines

BOI vs Non-BOI

- BOI Entities: Must file periodic reports

- Non-BOI: Subject to standard duties

Other Authorities

Central Bank of Sri Lanka

- Foreign Shareholders: Must use Securities Investment Account (SIA)

- FX Reporting: Required for remittances

Labour Department

- EPF/ETF Contributions: Monthly filings

- Gratuity & Termination: As per statutory guidelines

Environmental Authority

- Licensing: Required for manufacturing or sensitive activities

- Renewals: Sector-specific

📅 Your 2025 Compliance Calendar

| Month | Task | Authority | Deadline |

|---|---|---|---|

| Jan–Feb | Prepare & audit financials | ROC / Auditor | Feb 28 |

| Mar | Board approval of accounts | ROC | Mar 15 |

| Apr | File Annual Return (Form 15) | ROC | Within 30 days of AGM |

| Aug | Submit Estimated Tax Statement | IRD | Aug 15 |

| Nov | Submit Final Tax Return | IRD | Nov 30 |

| Monthly | VAT, WHT, EPF/ETF filings | IRD / Labour Dept | 15th of each month |

| Quarterly | ESC payments | IRD | 15th of quarter |

Pro Tips for Staying Compliant

- Software to automate reminders and track filings

- Maintain statutory records for at least 5 years

- Schedule quarterly board meetings to stay governance-ready

- Create a Notion or Excel dashboard with conditional alerts

Final Thoughts

Compliance isn’t just about ticking boxes—it’s about building trust, protecting your brand, and enabling sustainable growth. With this calendar in hand, your company can navigate Sri Lanka’s regulatory landscape with confidence and clarity.