Sri Lanka is an emerging hub for regional investment, offering a strategic location, skilled workforce, and evolving infrastructure. If you’re considering registering a company in Sri Lanka, here are the key areas you should understand before making your move:

1. Registration Process & Timeline

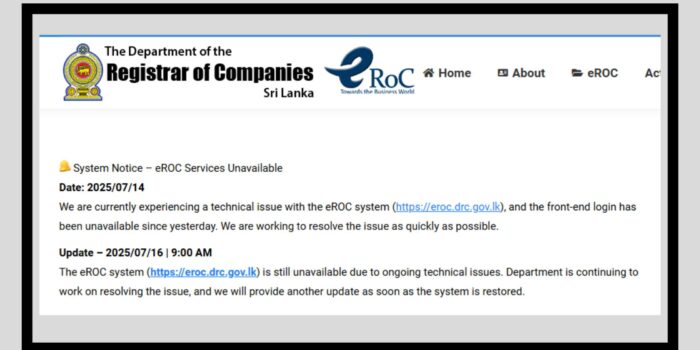

The company registration process in Sri Lanka is streamlined and digital. While the technical steps are handled by professionals like us, investors should know that the process typically takes 3–5 working days once all documents are in order. Our team ensures a smooth experience from name reservation to incorporation.

2. Industries Allowing 100% Foreign Ownership

Sri Lanka welcomes foreign investment in several sectors with full ownership rights:

- Information Technology & Software Development

- Business Process Outsourcing (BPO)

- Construction & Infrastructure

- Hospitality & Tourism

- Professional Services

- Retail Trade (with a minimum investment of USD 5 million)

These sectors offer high growth potential and minimal regulatory barriers for foreign investors.

3. Restrictions on Foreign Ownership

Certain industries have limitations or require special approvals:

- 40% cap: Education, travel agencies, mass communication, shipping, timber, agriculture.

- Ministry approval required: Air transport, gem mining, military equipment, pharmaceuticals.

- Reserved for locals: Pawn brokering, money lending, coastal fishing, retail trade under USD 5 million.

Understanding these restrictions helps in choosing the right business model and structure.

4. Alternative Options: BOI & Port City Colombo

Board of Investment (BOI):

- Section 16: Allows 100% foreign ownership with a minimum investment of USD 250,000.

- Section 17: Offers tax holidays and duty exemptions for larger investments.

Port City Colombo:

- A Special Economic Zone offering:

- 100% foreign ownership

- Tax-free status

- Operations in foreign currency

- Streamlined regulations via CPCEC

These options are ideal for large-scale or export-oriented ventures.

5. Corporate Taxation

Sri Lanka’s corporate tax structure is sector-based:

- Standard rate: 30%

- Service exports: 15%

- Strategic sectors: 18%

- Liquor, tobacco, gaming: 45%

Note: SMEs are no longer subject to a separate 15% tax rate based solely on turnover. They must apply the standard corporate tax rate unless they qualify under specific concessionary categories.

Proper tax planning can significantly impact profitability.

6. VAT and Other Taxes

- VAT: 18% (standard rate)

- Threshold: Rs. 60 million annually

- Other applicable taxes:

- Social Security Contribution Levy

- CESS and PAL (on imports)

- Withholding Tax (14% on dividends and service payments to non-residents)

Understanding these helps in pricing and financial forecasting.

7. Labour Laws Overview

Sri Lanka has a structured labour law framework:

- EPF: 8% employee + 12% employer contribution

- ETF: 3% employer contribution

- Gratuity: Payable after 5 years of service (½ month’s salary per year)

- Termination: Requires approval from the Labour Commissioner for non-voluntary terminations

Compliance with these laws ensures smooth HR operations and employee satisfaction.

8. Bank Account Opening

Opening a corporate bank account requires:

- Certificate of Incorporation

- Board Resolution

- KYC documents

- UBO declaration

Banks offer various account types including foreign currency accounts for international transactions. We assist in selecting the right banking partner for your business needs.

Ready to invest in Sri Lanka? Let our expert team handle your company registration and compliance needs while you focus on building your business.